Table of Contents

TogglePlanning a journey to the magnificent landscapes and bustling cities of China? One of the key aspects to a smooth trip is understanding how to manage your payment in China. This article is a comprehensive guide to demystify the China payment ecosystem. We’ll explore everything from dominant mobile payment apps to the role of cash and cards, ensuring you can navigate transactions with ease and confidence.

Understanding Mobile Payment in China

China has leapfrogged into a near-cashless society, with mobile payments becoming the undisputed champion for daily transactions. An astonishing 80-92% of everyday purchases, from street food to luxury goods, are made using smartphones. This widespread adoption of digital wallets means that mastering mobile payment in China is not just a convenience, but often a necessity for travelers.

Alipay: Your Top Choice for Foreigner-Friendly Payment in China

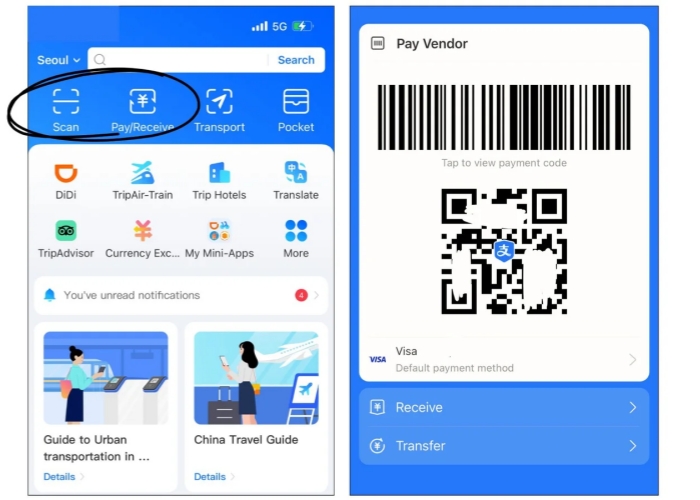

Alipay is the most widely used mobile payment platform in China, boasting over 1.3 billion users and a significant market share. For international visitors, Alipay stands out due to its relatively straightforward setup process for its international version.

How to Set Up Alipay:

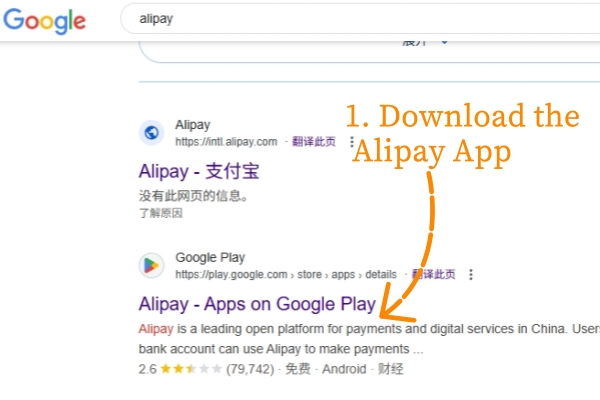

1. Download the App: Get the Alipay app from Google Play Store or Apple App Store before you travel or upon arrival.

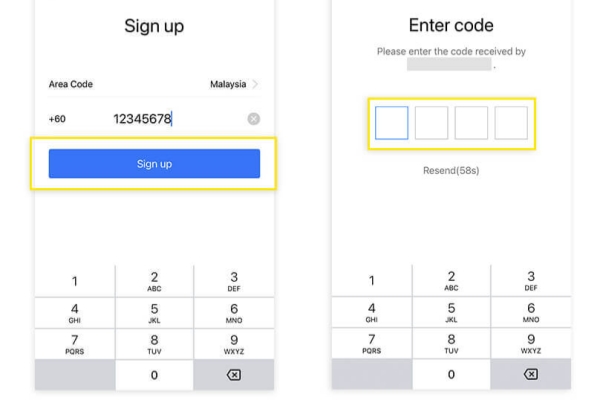

2. Register an Account: You can typically register using your international phone number and email address.

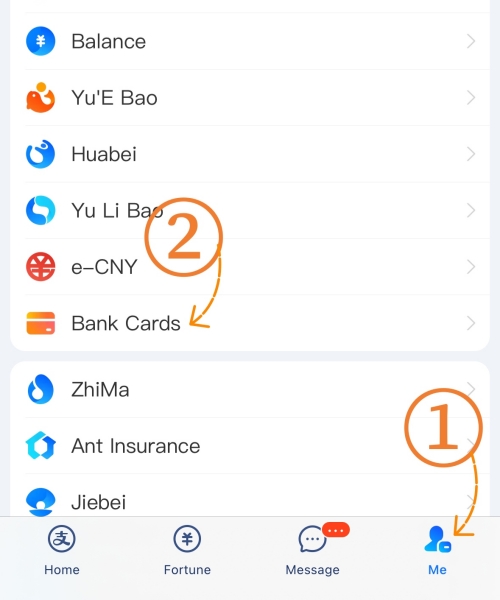

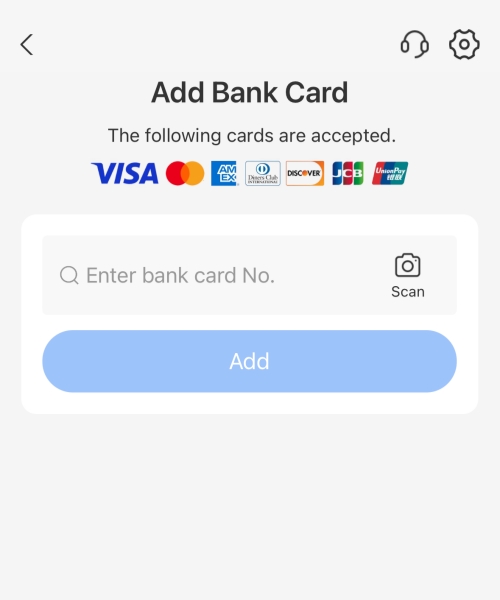

3. Link Your International Card: Navigate to “Me” → “Bank Cards” → “Add Card.” Alipay supports major international credit cards like Visa, Mastercard, Diners Club, and Discover. A Chinese bank account or phone number is generally not required for this.

4. Identity Verification: You might need to provide passport information for verification. Some users report that wallet activation for international cards can take up to 24 hours.

5. Using Alipay: To make a payment in China, you can either scan the merchant’s QR code or present your own payment QR code for the merchant to scan. Alipay also integrates services like Didi (ride-hailing) and options for public transport payments in many cities.

WeChat Pay: The All-in-One App for Communication and Payment in China

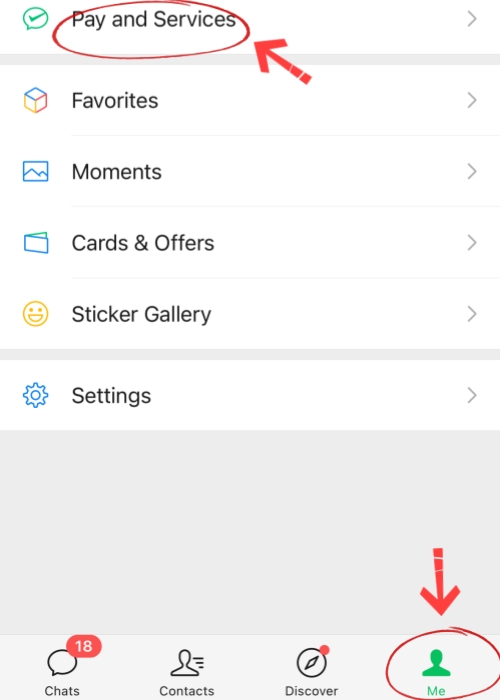

WeChat Pay is integrated within the ubiquitous WeChat messaging app, making it an incredibly versatile tool. Beyond just payment in China, WeChat is used for social networking, booking services, and much more. If you plan on communicating with locals or using “mini-programs” for services, WeChat Pay is very convenient.

How to Set Up WeChat Pay:

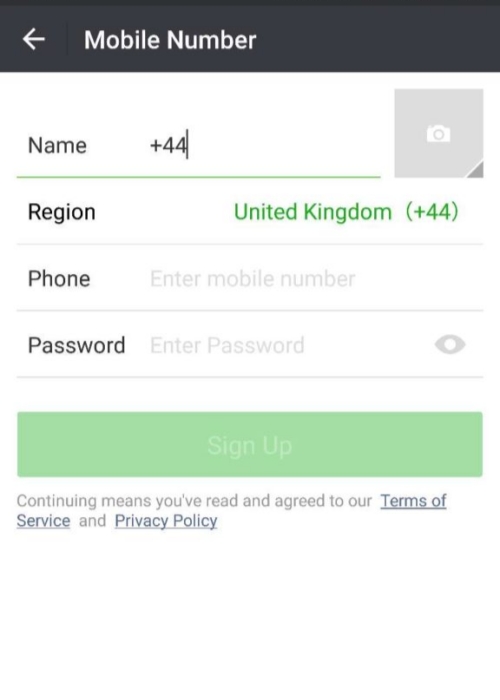

- Download WeChat: Install the WeChat app from your respective app store.

- Register an Account: Sign up using your phone number. You may need verification from an existing WeChat user.

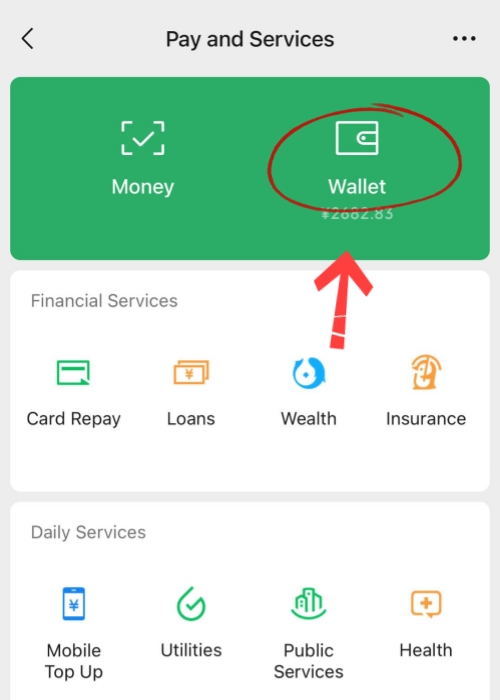

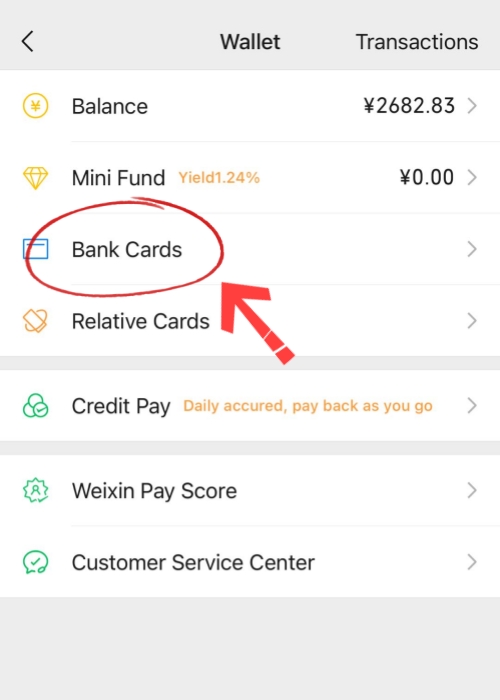

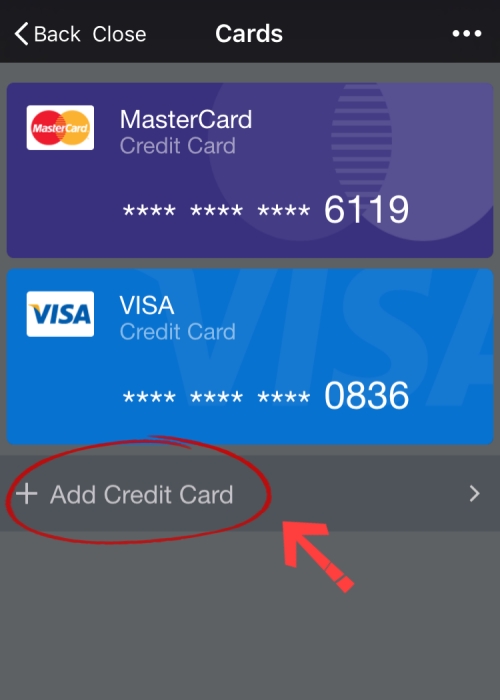

- Access WeChat Pay (Wallet): Go to “Me” → “Pay and Services”.

- Link Your International Card: Select “Wallet” → “Bank Cards” → “Add a Bank Card.” WeChat Pay also supports international cards like Visa and Mastercard. You’ll likely need to provide passport details for identity verification.

- Activation: Similar to Alipay, there might be a verification period.

WeChat Pay is accepted virtually everywhere, just like Alipay. The choice between them often comes down to personal preference or ease of setup. For transactions under RMB 200, you might avoid a small service charge (around 3%) that can sometimes apply to larger payments made with linked international cards on these platforms.

Traditional Payment in China

While digital is dominant, traditional methods of payment in China still have their place, especially as backups or in specific scenarios.

Cash (RMB): Still Useful in Certain Situations

Despite the digital wave, carrying some cash (Chinese Yuan, also known as Renminbi or RMB) is advisable. While many urban vendors, even street stalls, prefer QR codes, cash remains essential in:

- Rural Areas: Connectivity might be limited, making mobile payments less reliable.

- Smaller Vendors: Some smaller, family-run shops or older vendors might still prefer cash.

- Emergency Backup: If your phone battery dies or you encounter issues with your mobile payment apps.

It’s recommended to carry a modest amount, perhaps around 200-500 RMB, in smaller denominations (¥1, ¥10, ¥50, ¥100 bills). ATMs are widely available in cities and towns for withdrawing cash using foreign debit cards, but be mindful of potential foreign transaction fees from your bank.

Credit and Debit Cards: Limited but Strategic Use

International credit and debit cards like Visa, Mastercard, and American Express are not the primary means of payment in China for daily transactions. Most local retailers, restaurants, and transportation services do not accept them directly. However, they are typically accepted at:

- High-end hotels and international hotel chains.

- Larger shopping malls and department stores, especially those catering to tourists.

- Some upscale restaurants and major tourist attractions.

Pro Tips for Seamless Payment in China

- Set Up Before You Go: Download and attempt to link your cards to Alipay and/or WeChat Pay before leaving your home country. This can save you hassle upon arrival.

- Ensure Internet Access: Mobile payments require an internet connection. Consider getting a local SIM card, an eSIM, or ensuring your international roaming plan is adequate. Public Wi-Fi is available but may not always be reliable or secure for financial transactions.

- Carry a Power Bank: Your smartphone is your wallet. Keep it charged!

- Learn Basic Phrases: Knowing a few Mandarin phrases related to payment (e.g., “扫码 – sǎo mǎ” – scan code, “支付宝 – Zhīfùbǎo” – Alipay, “微信支付 – Wēixìn Zhīfù” – WeChat Pay) can be helpful.

- Test Small Transactions: Once set up, make a small purchase to ensure your chosen mobile payment method is working correctly.

- Have Backups: Don’t rely on a single method for payment in China. Ideally, have one or two mobile payment apps set up, some cash, and an international credit/debit card.

Frequently Asked Questions (FAQs) about Payment in China

Can I use Apple Pay or Google Pay for payment in China?

Apple Pay has very limited acceptance in China and typically requires a UnionPay-enabled card. Google Pay is generally not accepted. It’s best to rely on Alipay or WeChat Pay.

Do I need a Chinese phone number to set up Alipay or WeChat Pay?

What if my mobile payment transaction fails?

First, check your internet connection. If it persists, try re-adding your card to the app. Sometimes, making multiple smaller payments can help if there’s an issue with a larger single transaction. If all else fails, resort to your backup cash or card if the vendor accepts it.

Are Alipay and WeChat Pay safe for payment in China?

Yes, both platforms use robust security measures, including encryption and fraud protection, making them safe for payment in China. However, always practice good digital hygiene, like using strong, unique passwords and being cautious about unsolicited QR codes or links.